Here is the text divided into sentences and with the mistakes corrected: What should you bring with you to an IRS audit? You should bring only those items that the IRS has requested for the audit. However, you should make sure to have all the items on the requested list if you have been contacted and asked to bring specific records. For example, if you've been asked to provide receipts to support charitable contributions, you need to ensure that you bring only those receipts. If you have stored your documents in containers, it is important to go through them and only take out what you need. Being organized with your documentation will help expedite the IRS audit. Therefore, while preparing your tax return, make sure to organize your information neatly. This will allow you to quickly access the necessary documentation if you are audited. Keeping your receipts and records organized will certainly make the audit process go smoother and faster. Should you have any items on your tax return that are audited, you need to be prepared and have the necessary documentation readily available.

Award-winning PDF software

Request irs audit Form: What You Should Know

Qualify for the ETC and the Child Tax Credit (CTC). You can send copies of your tax return or IRS 1040, W-2s, or other evidence to us as soon as your tax preparer or service provider has completed the form required by the IRS. IRS Audit Exemptions | Internal Revenue Service Aug 9, 2025 — The IRS provides tax information on the IRS.gov website for exempt organizations, such as churches, that apply for the Religious Exemption Program. What do I do if you audit me for not reporting business income and/or expenses? • The IRS is allowed to conduct an audit of your business income/expenses only if they have a 'reasonable basis to believe' the information is false or was knowingly and intentionally obtained by false or fraudulent means. What to do if the IRS audits my church? You are also eligible for audit by the IRS if both: • There are problems in your church's internal control or in financial and personnel management; and • The IRS has a reasonable basis to do its audit of you (such as a finding that church's financial statements are in disarray). How do I file a complaint with the IRS? The IRS will only pursue complaints if there is a basis for pursuing the complaint against the IRS. Complaints may be filed at any IRS Taxpayer Identification Number website and can be filed anytime. How do I file a complaint if I have questions about my complaint? Taxpayers with questions should call the Internal Revenue Service at or file an online complaint with the IRS. How do I file a complaint if someone has been acting in a manner consistent with the law and I should have known about the fraud? You may file a complaint against the IRS if you believe the IRS is engaging in or has been conducting fraudulent actions. The IRS may determine that you have no reasonable cause to complain, and you may not be the subject of an audit. Why do I have to pay the back taxes? Although the IRS is allowed to conduct an audit, the penalty for failing to pay the tax includes a 10-year bar on collecting the tax from you. The penalty starts to run after 30 years, even if the original penalty assessment date occurred before 1990. This is called an abatement of penalty. Can the IRS audit or pursue an enforcement action against me for failure to pay its back taxes? Yes.

online solutions help you to manage your record administration along with raise the efficiency of the workflows. Stick to the fast guide to do Form 4549, steer clear of blunders along with furnish it in a timely manner:

How to complete any Form 4549 online: - On the site with all the document, click on Begin immediately along with complete for the editor.

- Use your indications to submit established track record areas.

- Add your own info and speak to data.

- Make sure that you enter correct details and numbers throughout suitable areas.

- Very carefully confirm the content of the form as well as grammar along with punctuational.

- Navigate to Support area when you have questions or perhaps handle our assistance team.

- Place an electronic digital unique in your Form 4549 By using Sign Device.

- After the form is fully gone, media Completed.

- Deliver the particular prepared document by way of electronic mail or facsimile, art print it out or perhaps reduce the gadget.

PDF editor permits you to help make changes to your Form 4549 from the internet connected gadget, personalize it based on your requirements, indicator this in electronic format and also disperse differently.

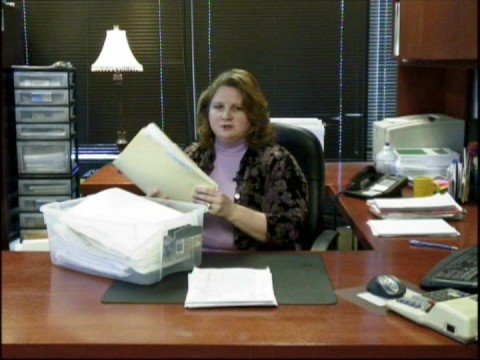

Video instructions and help with filling out and completing Request irs audit